Revenue Analyses:

Income Tax Analyses:

Numbers — Charts:

| Tweet | | Contact | Follow @chrischantrill |

What is the Federal Government Revenue?

In FY 2025, federal government revenue was $5.23 trillion according to the Office of Management and Budget. Budgeted revenue for FY 2026 is $5.87 trillion.

Federal Revenue Analysis

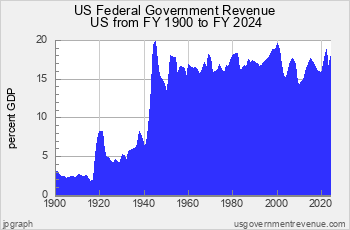

This page shows the current trends in US Federal revenue. There are also charts on US Federal revenue history.

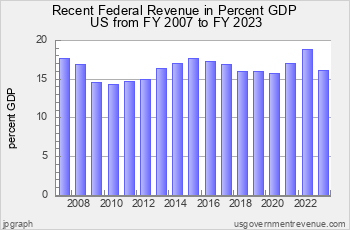

Recent US Federal Revenue

Revenue Analyses:

Income Tax Analyses:

Numbers — Charts:

Suggested Video: Taxes 101

Top Revenue Requests:

Find DEFICIT stats and history.

US BUDGET overview and pie chart.

Find NATIONAL DEBT today.

DOWNLOAD revenue data.

See FEDERAL BUDGET breakdown and estimated vs. actual.

Check INCOME TAX details and history.

See BAR CHARTS of revenue.

Check STATE revenue: CA NY TX FL and compare.

See REVENUE ANALYSIS briefing.

See REVENUE HISTORY briefing.

Take a COURSE at Taxes 101.

Make your own CUSTOM CHART.

Revenue Data Sources

Revenue data is from official government sources.

- Federal revenue data since 1962 comes from the president’s budget.

- All other revenue data comes from the US Census Bureau.

Gross Domestic Product data comes from US Bureau of Economic Analysis and measuringworth.com.

Detailed table of revenue data sources here.

Federal revenue data begins in 1792.

State and local revenue data begins in 1820.

State and local revenue data for individual states begins in 1957.

Site Search

Spending 101

Take a course in government spending:

Spending |

Federal Debt |

Revenue

Defense |

Welfare |

Healthcare |

Education

Debt History |

Entitlements |

Deficits

State Spending |

State Taxes |

State Debt

It’s free!

Win Cash for Bugs

File a valid bug report and get a $5 Amazon Gift Certificate.

Get the Books

Price: $0.99 Or download for free. |

From usgovernment spending.com Price: $1.99 |

Life after liberalism Price: $0.99 Or download for free. |

Data Sources for 2014_2029:

Sources for 2014:

GDP, GO: GDP, GO Sources

Federal: Fed. Budget: Hist. Tables 2.1, 2.4, 2.5, 7.1

State and Local: State and Local Gov. Finances

Sources for 2029:

GDP, GO: GDP, GO Sources

Federal: Fed. Budget: Hist. Tables 2.1, 2.4, 2.5, 7.1

State and Local: State and Local Gov. Finances

'Guesstimated' by projecting the latest change in reported revenue forward to future years

> data sources for other years

> data update schedule.

Blog

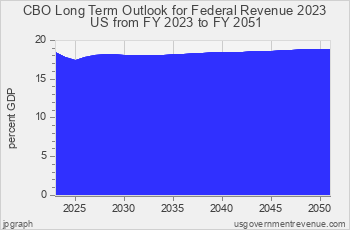

CBO Long Term Budget Outlook for 2025

On March 27, 2025 the Congressional Budget Office released its annual Long Term Budget Outlook for 2025, which projects federal spending and revenue out to 2055. As before, the data for the CBO study shows that federal health-care programs and interest costs will eat the budget, with federal spending exceeding 25 percent GDP by the 2040s while federal revenue stays a little over 19 percent GDP.

UsGovernmentspending.com has updated its chart of the CBO Long Term Budget Outlook here. You can download the data and also view CBO Long Term Budget Outlooks going back to 1999.

On November 22, 2025 usgovernmentspending.com updated FY2025 state revenue with quarterly tax data released by the US Ce ...

The US Bureau of Economic Analysis (BEA) released its Gross State Product (GSP) data for 2024 on March 29, 2025.Usgovernmen ...

> blog

usgovernmentrevenue.com

presented by Christopher Chantrill